Self employed tax Spain regulations require freelancers and autónomos to navigate a complex system of obligations. Understanding how much tax freelancers pay in Spain is essential for legal compliance and financial planning. Spanish tax law mandates various contributions, including income tax, social security payments, and potentially VAT, depending on the nature of the freelance activity.

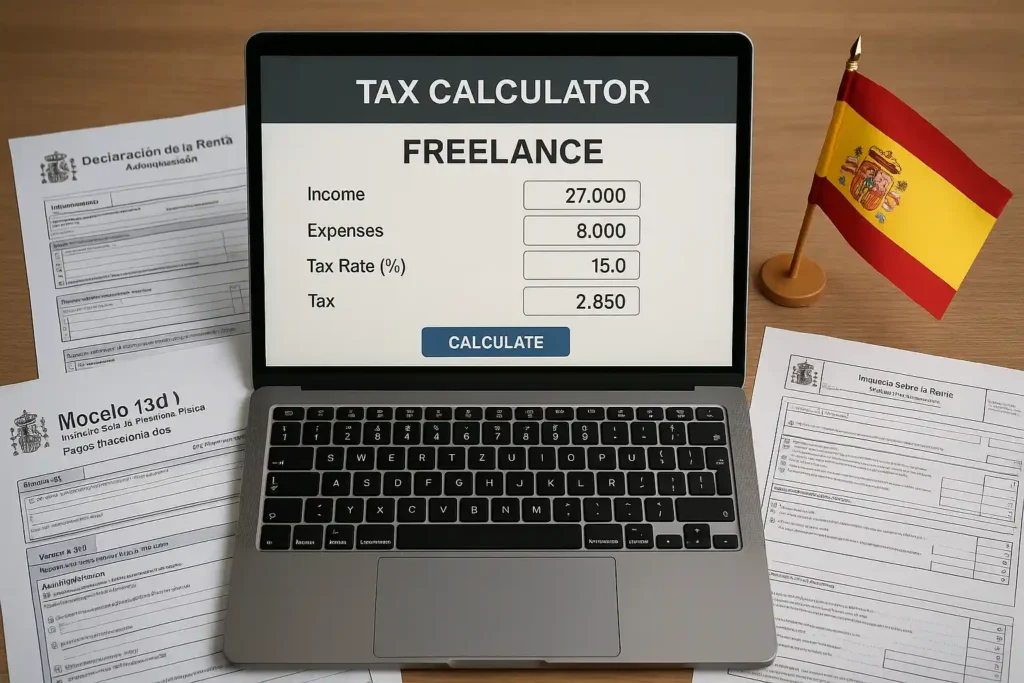

Questions such as how much tax do I pay as a freelancer? or how is tax calculated in Spain? often arise among self-employed professionals. The Spain tax calculator can be a useful tool in calculating your tax liability based on your earnings and deductible expenses, making precise calculation critical to avoid penalties.

This article covers key components of self-employed taxes in Spain:

- Breakdown of income tax and social security contributions

- Step-by-step guide to calculate freelance taxes using an online calculator

- Practical tips for managing tax obligations efficiently

Freelancers looking to understand how much is self employed tax in Spain will find actionable insights here to optimize their fiscal responsibilities. Accurate calculation and timely filing safeguard against legal risks while supporting sustainable business growth.

For those seeking ways to ease their tax burden, exploring 7 legal ways to reduce taxes in Spain could provide valuable insights. Additionally, high-earning expats might benefit from understanding the Beckham Law, which offers significant tax advantages.

Lastly, it’s important for freelancers to understand the distinction between different tax models such as Autónomo vs SL, as this could influence their overall tax strategy.

Calculating Your Freelance Taxes in Spain Using a Tax Calculator

Self-employed professionals in Spain, including those on the Spain Digital Nomad Visa, face a complex tax landscape that includes income tax (IRPF), social security contributions, and potentially VAT. A freelance calculator Spain or Spain freelance tax calculator can simplify this process by providing an estimate of total taxes payable based on your specific financial data.

Step-by-Step Guide to Using a Spain Tax Calculator for Expats and Freelancers

- Input Gross Income

- Enter your total annual invoiced amount before any deductions. This figure represents your earnings as an autónomo or freelancer, which you can learn more about in this guide on how to become an autonomo in Spain.

- Deductible Expenses

- Include allowable business expenses such as office supplies, professional services, and partial home office costs. The calculator adjusts taxable income accordingly.

- Social Security Contributions

- Input monthly social security payments, which vary depending on your base rate selection but have minimum and maximum thresholds regulated by Spanish law.

- Personal Allowances and Deductions

- Specify personal circumstances affecting tax liability, such as marital status, number of dependents, and applicable personal allowances under Spanish tax legislation.

- VAT Considerations (if applicable)

- If registered for VAT (IVA), input VAT collected and paid to calculate net VAT owed or refundable.

- Calculate IRPF (Income Tax)

- The tool applies progressive IRPF rates based on taxable income after deductions, reflecting the range from approximately 19% to 47%.

- Review Estimated Total Tax Payable

- The calculator summarizes your estimated annual tax burden, combining IRPF and social security contributions.

Example Calculation Scenario

- Gross annual income: €30,000

- Deductible expenses: €6,000 (including partial home office and professional supplies)

- Monthly social security contribution: €300 (€3,600 yearly)

- Personal allowance: Single individual, no dependents

Using a typical Spain tax calculator, the steps would output:

- Taxable income after expenses: €24,000

- Estimated IRPF: Approximately €3,800 (based on progressive scale)

- Social security contributions: €3,600 yearly

Total estimated taxes payable: €7,400 per year

This example highlights how deductibles reduce taxable income substantially while social security remains a fixed monthly commitment vital for healthcare and pension benefits.

Employing a reliable freelance calculator tailored to Spanish contexts provides clarity on tax obligations and helps prevent surprises during filing deadlines. Adjusting inputs for changing incomes or deductions allows freelancers to plan finances prudently throughout the fiscal year. For expats navigating these waters, understanding the Spanish tax system is crucial for maximizing benefits and ensuring compliance.

Maximizing Deductions: What Expenses Can You Claim as a Freelancer in Spain?

Understanding deductible expenses freelancer Spain allows self-employed individuals to reduce taxable income effectively. The Spanish tax authorities recognize several categories of expenses directly linked to business activity, which can be claimed to lower your self employed tax Spain burden.

It’s also crucial for freelancers in Spain to stay updated on Spain’s 2025 tax brackets, which can help in effective financial planning and maximizing deductions.

Common Deductible Business Expenses

1. Office costs

Rent, utilities, internet, phone bills, and office supplies are deductible when used for professional purposes. If you rent an office space or coworking desk, the entire cost is generally deductible.

2. Vehicle expenses

If a vehicle is used partly for work, 50% of the associated expenses such as fuel, maintenance, insurance, and depreciation can be deducted. Accurate records must support the proportion of professional use.

3. Home office proportional expenses

For freelancers working from home, a portion of household expenses qualifies as deductible. This typically includes electricity, water, gas, and internet costs proportional to the workspace size—usually around 30%. This category is often referred to as work from home deductions Spain.

4. Professional supplies and equipment

Purchases like computers, software licenses, stationery, and other materials necessary for performing your work are fully deductible.

Meal Expense Deductions

Spanish tax law sets daily limits on meal expense deductions related strictly to business activity:

- €26.67 per day for local meals within Spain.

- €48.08 per day for meals during international travel related to work.

Expenses beyond these limits cannot be deducted. Proper documentation such as invoices or receipts must accompany these claims.

Health Insurance Premiums

Self-employed individuals may deduct health insurance premiums paid for themselves and their family members up to a maximum of €500 per year. This deduction applies exclusively if the policy is contracted with authorized insurers in Spain.

Accurate bookkeeping and clear documentation are essential in substantiating deductible expenses. Misclassification or unsupported claims risk penalties by the Spanish tax authorities.

Freelancers should also be aware of common tax deductions available for expats living in Spain. These can significantly optimize tax liabilities and aid in navigating Spain’s taxation system efficiently.

Filing Your Freelance Taxes in Spain: Deadlines and Forms You Need to Know

Filing freelance taxes in Spain requires specific forms and strict deadlines to comply with Spanish tax law. Understanding the timing and documentation involved is crucial for freelancers and autónomos managing their tax obligations efficiently.

Key filings include:

- Annual Income Declaration (Modelo 100):

- This form serves as the annual personal income tax return (IRPF) where freelancers declare total earnings, deductions, and calculate final tax liability. The deadline for submitting Modelo 100 falls between June and July of the calendar year following the fiscal year reported. For example, income earned during 2023 must be declared by mid-2024.

- Quarterly Tax Payments (Modelo 130 or Modelo 131):

- Self-employed individuals generally must make advance payments on their estimated income tax quarterly using Modelo 130 (direct estimation method) or Modelo 131 (objective estimation method). These payments act as prepayments toward your annual tax bill, reducing potential large balances at year-end. Quarterly deadlines are fixed as follows:

- April 20th for Q1 (January–March)

- July 20th for Q2 (April–June)

- October 20th for Q3 (July–September)

- January 30th of the following year for Q4 (October–December)

Missing these deadlines can result in penalties and interest charges, making timely submission essential.

|

Form Purpose Due Dates Modelo 100 |

Annual income declaration |

June–July after fiscal year end |

|

Modelo 130/131 |

Quarterly income tax payments |

April/July/October/January |

Adopting a disciplined schedule for filing freelance taxes in Spain helps maintain legal compliance while avoiding unnecessary financial risks. Keeping track of these key dates supports smoother tax management throughout the year.

How Much Can You Earn Before Paying Tax in Spain? Understanding the Thresholds

Determining how much can you earn before paying tax in Spain is crucial for self-employed individuals aiming to manage their tax obligations effectively. Spanish tax law establishes minimum exempted personal allowance thresholds which vary based on personal circumstances such as marital status and number of dependents.

Key points regarding these thresholds include:

- General Personal Allowance: For most taxpayers, the basic minimum exempt amount is €5,550 per year. Income below this level is not subject to income tax (IRPF).

- Age-related Allowance: Taxpayers over 65 years old benefit from an increased allowance of €6,700 annually, recognizing higher living costs associated with retirement age.

- Disability Allowance: Additional allowances apply if the taxpayer or dependents have recognized disabilities, ranging from €3,000 up to €12,000 depending on severity.

- Family Situation Impact:

- Married couples filing jointly may combine allowances.

- Parents with dependent children qualify for extra deductions.

- Single parents receive specific benefits to lower taxable income thresholds.

Understanding how much can you earn in Spain before paying tax depends on compiling all applicable allowances and deductions. Earnings exceeding these thresholds trigger progressive tax rates starting typically at 19% for lower income brackets.

Careful evaluation of personal circumstances ensures accurate calculation of taxable income and prevents overpayment or penalties. Awareness of these exemptions plays a vital role when planning freelance earnings and tax liabilities.

Conclusion

Understanding self employed tax Spain requires accurate calculations and adherence to legal obligations.

- Use freelance tax calculators as a starting point for estimating liabilities.

- Seek professional advice tailored to your specific circumstances for precision.

- Maintain compliance with all necessary filings:

- IRPF (personal income tax) declarations

- Social security contributions

- VAT returns when applicable

Adhering to these key responsibilities ensures smooth operation within Spanish tax law and avoids penalties. Trustworthy guidance and diligent management form the foundation of responsible freelancing in Spain.