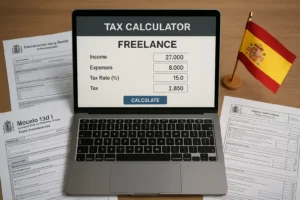

Spain’s growing startup ecosystem and access to the €4.5 trillion EU market make it an attractive destination for foreign entrepreneurs. Whether you choose to operate as a freelancer (autónomo) or set up a limited company (Sociedad Limitada), both paths have unique benefits—and bureaucratic hurdles. From NIE registration to social security contributions, and deciding between a €150 or €7,500+ setup, success requires solid preparation. Still, with 89% of foreign businesses profitable within 3 years, Spain remains a promising launchpad for international founders.