Introduction: Beyond Cost Comparison – Your 2026 Financial Viability Roadmap

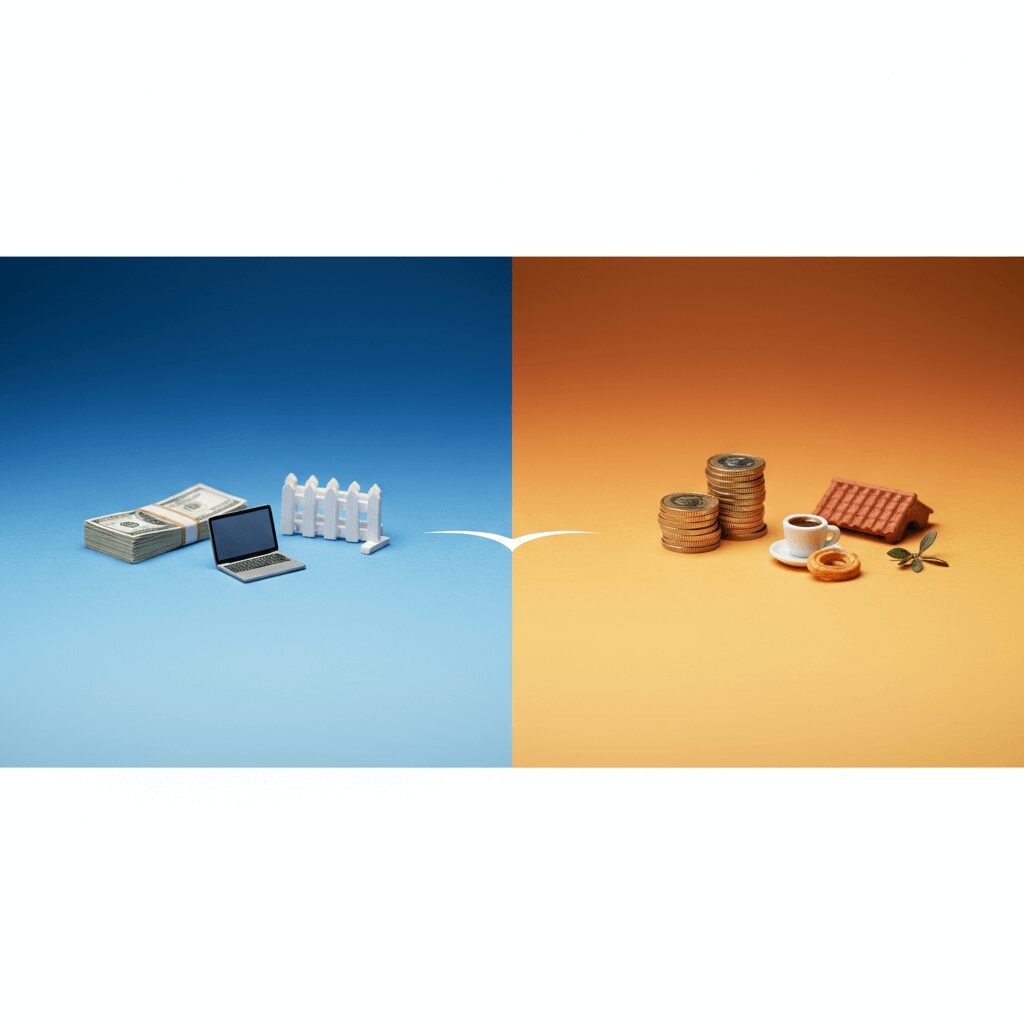

For Americans contemplating a move across the Atlantic in 2026, the question of whether it’s cheaper to live in the USA or Spain is far more nuanced than a simple budgetary tally. This article moves beyond surface-level comparisons, offering a personalized financial viability roadmap designed specifically for the discerning individual or family. Our unique approach integrates 2026 social security spain benefits projections with real-time cost-of-living data, demonstrating precisely how these two critical factors interact to determine genuine financial feasibility. We aim to present a comprehensive framework for understanding your 2026 financial viability when considering relocation to Spain 2026, allowing you to assess not just affordability, but true financial well-being.

Traditional cost comparisons often overlook the dynamic interplay of income streams, particularly the impact of Social Security benefits, inflation, and fluctuating exchange rates. Our methodology addresses these complexities head-on, providing actionable insights tailored to diverse demographic profiles. By focusing on how your projected 2026 Social Security benefits translate into purchasing power and quality of life, we offer a forward-looking perspective essential for any significant international move.

Persona 1: The Young Professional’s 2026 Social Security & Lifestyle Optimization in Spain

For a young professional Spain 2026, the decision to relocate isn’t solely about immediate savings but also about long-term career growth, lifestyle enrichment, and future financial security, including understanding their social security contributions. This persona typically hasn’t accrued significant Social Security benefits yet, but their contributions in Spain will play a role in their overall financial picture. Our financial viability flowchart for young professionals considers not only estimated living expenses but also the potential for salary growth, career flexibility, and the long-term impact of Spanish social security contributions.

The flowchart begins with an assessment of projected 2026 income in Spain, accounting for typical entry or mid-level salaries in urban centers like Madrid or Barcelona. This is then weighed against estimated expenses including rent, utilities, transport, leisure, and a detailed breakdown of social security contributions in Spain. While direct US Social Security payouts are unlikely for this demographic in 2026, understanding the Spanish system is crucial for their integration into the workforce. Comparing potential disposable income and quality of life metrics against similar professional opportunities in the USA offers a clearer picture.

A hypothetical young professional earns €35,000 annually in Spain. After taxes and social security contributions (roughly 6.45% of their base salary for employees in 2026, though employer contributions are significantly higher), their net income might be around €27,000. Rent for a modest apartment in a major Spanish city could be €800-€1000 per month, impacting disposable income significantly. In contrast, a similar professional in a US city with a $60,000 salary could face higher rents and healthcare costs, potentially negating the higher gross income.

Navigating 2026 Tax Treaties for US Expats: Young Professional Edition

Understanding 2026 tax treaties Spain is paramount for young professionals, especially concerning social security income expatriates, even if direct US Social Security benefits are years away. While they may not be receiving US Social Security benefits, their current income from US sources, if any, and their future US Social Security eligibility are influenced by these agreements. For the young professional expat taxes, the primary concern revolves around avoiding double taxation on current earnings and understanding how their Spanish social security contributions interface with the US system.

According to insights from KPMG and Deloitte’s 2026 tax guides for expatriates, the US-Spain tax treaty aims to prevent individuals from paying income tax on the same earnings in both countries. This is primarily achieved through mechanisms like the Foreign Earned Income Exclusion (FEIE) and foreign tax credits. Young professionals working in Spain will generally be subject to Spanish income tax on their salary. For their US tax obligations, they can typically exclude a significant portion of their foreign earned income (projected to be over $120,000 in 2026) or claim a credit for taxes paid to Spain, effectively mitigating double taxation.

Regarding Social Security, the US-Spain Totalization Agreement is crucial. This agreement, designed to prevent double taxation of Social Security contributions and fill gaps in benefit coverage for workers who divide their careers between the two countries, primarily affects retirement, disability, and survivor benefits. For a young professional, it means that periods of employment in Spain for which Spanish social security contributions were made can potentially count towards US Social Security eligibility, and vice-versa, preventing a loss of benefits due to insufficient work credits in either system. This is a vital long-term financial planning consideration.

Persona 2: Family Life in Spain – Maximizing 2026 Social Security for Education & Community

For families considering family relocation Spain 2026, the financial viability flowchart must intricately weave together not just living expenses, but also significantly higher costs associated with children, such as education and healthcare. The integration of social security spain family benefits, whether from the US or accrued in Spain, becomes a cornerstone of their financial planning. Our approach emphasizes how these benefits can support a vibrant family life and access to quality education and community resources.

The flowchart for families starts with aggregated projected 2026 income, which might include one or two parental incomes, and crucially, any existing US Social Security benefits for which they or their children might be eligible. From this, significant expenses for housing (typically requiring larger spaces), healthcare (considering family plans), and particularly education costs in Spain are budgeted. Spain offers both public and private schooling options, with public schools being free for residents (excluding some materials and extracurriculars), while private international schools can cost upwards of €10,000-€20,000 per child annually in 2026, a critical differentiator from the US.

Community integration is also a financial consideration, encompassing extracurricular activities, local sports clubs, and family outings. These costs, while seemingly minor individually, add up quickly for a family. When comparing against the USA, families often find that while housing in major US cities can be significantly higher, certain education costs (especially for public K-12) might be perceived as “free” due to property taxes, though the tax burden itself is substantial.

Case Study: A Family’s 2026 Financial Journey from US to Spain

Consider the “Gonzales Family,” with two parents, two school-aged children (ages 8 and 12), and one parent receiving an average of $2,500/month in US social security payouts 2026. The other parent secures a remote job with a Spanish company, earning €45,000 annually. Their combined monthly income, assuming a 1.08 USD/EUR exchange rate in 2026, is approximately €2315 (from Social Security converted) + €3,460 (net salary after Spanish taxes and Social Security contributions) = €5,775.

Their estimated expenses in Valencia, Spain (a popular family destination):

-

Rent for a 3-bedroom apartment: €1,200

-

Utilities (electricity, water, internet): €250

-

Groceries: €800

-

Public school supplies & activities: €150

-

Private health insurance (family plan): €350

-

Transportation: €100

-

Leisure & dining: €400

Total estimated monthly expenses: €3,250. This leaves a comfortable €2,525 in disposable income. In contrast, if they stayed in a mid-sized US city, their combined gross income might be higher ($5,000 Social Security + $60,000 salary), but housing in many US metro areas for a family could easily exceed $2,500-$3,500/month, and private health insurance might be $1,000+/month, significantly reducing their financial outcome.

This case study illustrates how the predictability of social security payouts 2026, combined with achievable local income and lower estimated expenses Spain for essentials like education and healthcare (especially if utilizing public options or affordable private insurance), can lead to a positive family financial outcome.

Persona 3: Retiree’s Golden Age in Spain – 2026 Social Security & Quality of Life

For the retiree Spain 2026, the primary financial driver is often their US social security retirement benefits. The allure of Spain lies in its promise of an affordable golden age Spain, characterized by a lower cost of living, excellent climate, and access to quality healthcare. Our financial viability analysis for retirees focuses intensely on maximizing the purchasing power of these benefits against the backdrop of Spanish living costs, healthcare options, and leisure activities.

The retiree’s financial flowchart centers on their projected 2026 Social Security benefits, which form the bedrock of their income. This is then meticulously compared against estimated expenses for housing (often a major reduction compared to the US), healthcare (a critical and often cost-saving factor in Spain), groceries, transportation, and leisure pursuits. Many retirees find that their fixed Social Security income stretches considerably further in Spain, allowing for a more comfortable and fulfilling retirement than might be possible in the USA.

A hypothetical retired couple might receive $4,500/month in combined US Social Security benefits in 2026. Converting this to Euros at a 1.08 USD/EUR exchange rate yields approximately €4,166. In Spain, they could rent a comfortable apartment for €700-€1,000, enjoy affordable healthcare options, and access fresh, inexpensive produce, leaving ample funds for travel and cultural activities. This contrasts sharply with many US locations where even modest housing can consume a significant portion of Social Security income, leaving little for discretionary spending.

Per Capita Quality of Life: What 2026 Social Security Buys in Spain vs. USA

Beyond raw numbers, the true measure is the quality of life Spain offers relative to the purchasing power of social security purchasing power. For a retiree in 2026, what their Social Security benefits *actually buy* in terms of goods, services, healthcare access Spain 2026, and leisure opportunities is profoundly different between the two countries. In Spain, an average retiree’s Social Security income can unlock a richer, more active lifestyle.

-

Housing: For similar square footage and amenities, rent or property purchase prices in many Spanish cities are significantly lower than in comparable US cities, freeing up substantial monthly income.

-

Healthcare: Spain operates a universal public healthcare system, accessible to legal residents, often with minimal out-of-pocket costs. Private health insurance, while often recommended for expats, is also considerably more affordable than in the US, allowing retirees to effectively budget for their medical needs without fear of crippling expenses.

-

Food & Groceries: Fresh, local produce, and high-quality Mediterranean diet staples are generally more affordable in Spain compared to the US, contributing to both health and savings. Dining out and enjoying local cafes are also budget-friendly leisure activities.

-

Transportation: Public transportation systems in Spanish cities are efficient and inexpensive, reducing reliance on private cars and associated costs (insurance, fuel, maintenance).

-

Leisure & Culture: Access to museums, historical sites, concerts, and social activities is often priced much lower in Spain, allowing retirees to engage more fully with their community and interests without financial strain.

In essence, the same amount of 2026 Social Security dollars, when converted to Euros and spent in Spain, often translates into a higher standard of comfort, reduced financial stress, and greater opportunities for enjoyment and personal fulfillment, particularly regarding readily available healthcare access Spain 2026.

The Impact of 2026 Exchange Rates on Retiree Social Security

The fluctuating 2026 exchange rates Spain between the US Dollar (USD) and the Euro (EUR) represents a pivotal factor for retirees relying on US social security currency impact. A favorable exchange rate means more Euros for every US dollar, directly enhancing purchasing power and the overall standard of living. Conversely, an unfavorable rate can reduce the effective income, necessitating careful budgeting and financial planning.

In early 2026, economists from institutions such as JP Morgan and Goldman Sachs predict a range for the USD/EUR exchange rate, with a general consensus around 1.05 to 1.12. For a retiree receiving $3,000 in monthly Social Security benefits, a shift from 1.05 to 1.12 USD/EUR means their monthly income, when converted, changes from approximately €2,857 to €2,678, a difference of nearly €180. This margin can significantly impact discretionary spending or even cover minor unforeseen expenses.

Prudent retiree financial planning in Spain should therefore account for potential exchange rate volatility. Strategies include maintaining a buffer in a Euro-denominated account, diversifying income sources if possible, and being aware of current market trends. While no one can perfectly predict future rates, understanding their potential influence on monthly budgets is critical for maintaining financial stability and enjoying a comfortable retirement in Spain.

Your 2026 DIY Financial Assessment Kit: Is Spain Cheaper For YOU?

Empowering you with the tools to answer the question, “Is Spain cheaper for me?” in 2026 is our ultimate goal. Our DIY financial assessment 2026 kit allows you to input your specific financial situation and lifestyle preferences, generating a personalized ‘Is Spain Cheaper for Me?’ score. This score goes beyond general comparisons, providing a granular look at your individual potential for financial well-being, deeply integrating your social security spain scenario.

The kit considers several key personal variables:

-

Your estimated 2026 US Social Security benefits (or projected income for younger professionals).

-

Your preferred lifestyle (e.g., urban vs. rural, frequency of dining out, travel habits).

-

Family size and educational needs.

-

Your health status and healthcare preferences.

-

Desired housing type and location within Spain.

By inputting these details, the kit calculates a comparative cost of living, overlays it with your projected income in Spain, and generates a score (e.g., from 1 to 10, where 10 indicates significantly cheaper and higher quality of life). This personalized score is your starting point for making an informed decision, tailored to your unique circumstances and not just broad averages.

Projected Healthcare Costs in 2026: Spain vs. USA (Public & Private)

Healthcare expenses are often a major determinant of overall living costs, especially for those relying on 2026 Social Security benefits. Understanding healthcare costs 2026 Spain versus the USA, encompassing both public vs private healthcare options, is vital. Spain’s public healthcare system is generally considered excellent, providing comprehensive coverage to legal residents who are contributing to the social security system or are retirees receiving benefits.

For US expats in Spain in 2026, once residency is established, many become eligible for the public system. For those who prefer private care or are required to have it for initial visa purposes, private health insurance in Spain is considerably more affordable than comparable plans in the USA. Average monthly premiums for a comprehensive private policy in Spain might range from €50-€150 per person, depending on age and coverage. In contrast, US healthcare expenses, even with employer-sponsored plans, often involve high deductibles, co-pays, and significant monthly premiums that can exceed several hundred to over a thousand dollars for individuals and families monthly, aside from the high costs of procedures.

When integrating current average 2026 Social Security benefits, often around $1,900 for an individual, the relative healthcare burden is stark. In Spain, a significant portion of this income is preserved due to lower or no public health premiums, whereas in the US, a substantial sum could be consumed by healthcare costs alone.

2026 Housing Market Trends: Impact on Living Costs in Spain and USA

The 2026 housing market Spain presents a complex but often more affordable landscape than the USA, directly influencing overall living costs. Predictions from Savills and CBRE for 2026 suggest continued growth in major Spanish cities, yet prices remain significantly below those in comparable US metropolitan areas. For instance, renting a 2-bedroom apartment in Barcelona might average €1,200-€1,800, while a similar property in a desirable US city like Seattle or Austin could easily command $2,500-$4,000+.

Housing trends USA for 2026 indicate a slow but steady increase in both rental and purchase prices, particularly in high-demand urban and suburban areas, according to analyses by the National Association of Realtors. This makes the US housing market a significant drain on income, especially when compared to the generally more accessible options in Spain. Even in Spain’s priciest cities, the cost-to-income ratio for housing is often more favorable.

This dynamic directly impacts the cost of living calculator for individuals and families. Lower housing costs in Spain mean a greater proportion of 2026 Social Security benefits or other income is available for other expenses, contributing significantly to a higher quality of life. For homeowners, property taxes in Spain are also generally lower than in many US states, adding another layer of savings over the long term.

Conclusion: Your Actionable Path to Financial Well-being in 2026 Spain

Deciphering whether Spain is cheaper than the USA in 2026 is no longer a rhetorical question; it’s a personalized calculation. This comprehensive guide has moved beyond general cost comparisons, establishing a practical, forward-looking roadmap that deeply integrates the nuances of social security spain benefits with real-world living expenses. We have provided actionable frameworks for young professionals, families, and retirees, demonstrating how your 2026 Social Security income can translate into tangible financial well-being and an enhanced quality of life in Spain.

By leveraging the insights from our persona-specific financial viability flowcharts, understanding the critical impact of 2026 tax treaties, healthcare costs, and housing market trends, you are now equipped with the knowledge to make informed decisions. The DIY Financial Assessment Kit empowers you to create a personalized ‘Is Spain Cheaper for Me?’ score, replacing conjecture with concrete, data-driven analysis for your unique circumstances.

Your path to financial well-being 2026 in Spain is within reach. Utilize these tools, meticulously plan your finances, and consider expert consultations on taxation and immigration. The comprehensive perspective offered here provides the foundation for your relocation practical tools, guiding you toward a financially secure and fulfilling life abroad. The question isn’t just about ‘cheaper,’ it’s about ‘better value’ for your every dollar and for your overall life experience.